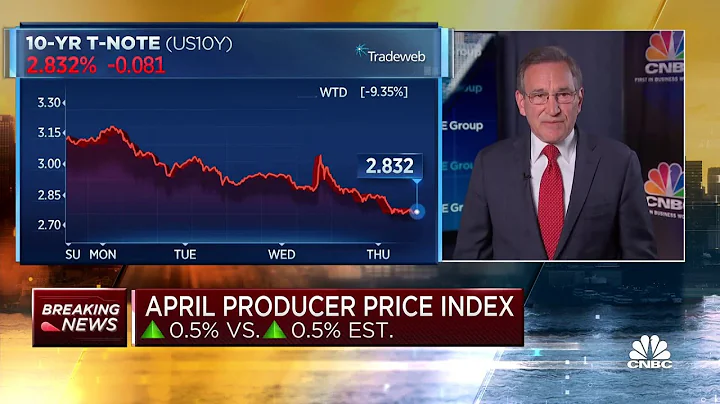

New evidence has been added to the “high fever” of U.S. inflation.

The latest data released by the U.S. Department of Labor shows that the U.S. Producer Price Index (PPI) rose by 0.8% month-on-month in February, doubling the increase in April; the year-on-year increase was 10.8%, narrowing 0.1 percentage points from the previous value. In March, US PPI increased by 11.5% year-on-year, reaching the highest level since records began in 2010.

"Following May's CPI data, the latest PPI data further confirms that inflationary pressures continue to build in goods and services." Mahir Rasheed, U.S. economist at Oxford Economics Writing in a report, the above data will force the Federal Reserve Open Market Committee (FOMC) to take decisive action to restore price stability.

The Federal Reserve monetary policy meeting was held in Washington on the 14th and 15th local time.

In early trading on Tuesday, U.S. stocks sentiment gradually stabilized. As of First Financial reporter's press time, the Dow rose 0.42%, the S&P 500 index and the Nasdaq rose 0.68% and 0.85% respectively.

The "75 basis point interest rate hike " club has added a new member

Before the market opened on Tuesday local time, Wells Fargo Chief Economist Bryson (Jay H. Bryson) predicted the interest rate hike at this Federal Reserve meeting Increased from 50 basis points to 75 basis points.

Bryson said that on the 13th, many mainstream U.S. financial media published reports that the Federal Reserve may raise interest rates by 75 basis points, which further strengthened his expectation. These reports are likely to come from informal comments by Federal Reserve officials, "helping To help investors quickly adjust market expectations, "

" Indeed, if the Fed still announces a 50 basis point interest rate hike as originally planned, we expect Powell to indicate more aggressive tightening in the future through a post-meeting press conference or a dot chart. Monetary policy," Bryson added.

The bank expects the Fed's latest dot plot to show that the federal funds rate (median) will climb to 3.375% before the end of the year.

So far, many well-known financial institutions on Wall Street including Goldman Sachs , JPMorgan Chase , Wells Fargo, Barclays and Jeffrey all predict that the Federal Reserve will announce a 75 basis point interest rate hike after the meeting on the 15th - this It will also be the Fed's largest single rate hike since 1994.

The Chicago Mercantile Exchange's FedWatch Tool shows that traders expect the probability of announcing a 75 basis point interest rate hike after Wednesday's meeting to soar to over 96% from 23.2% the previous day.

Not only that, traders expect that the probability of the federal funds rate target range climbing to 3.50%-3.75% and above before the end of this year is only 85%, which means that in the remaining five regular monetary policy meetings this year, the Federal Reserve may raise interest rates in total. 275 basis points, that is, including two interest rate hikes of 75 basis points, two interest rate hikes of 50 basis points, and one interest rate hike of 25 basis points.

U.S. PPI is expected to show signs of stabilization in the second half of this year

U.S. PPI is expected to show signs of stabilization in the second half of this year

Data shows that the sharp rise in U.S. PPI in May was mainly affected by rising gasoline prices. That month, commodities increased by 1.4% month-on-month, rising for the fifth consecutive month. Over 70% of the increase can be traced to energy prices, which rose 5% month-on-month. At the same time, service prices turned from falling to rising month-on-month, rising by 0.4%, of which more than half of the increase can be traced to the 2.9% month-on-month increase in transportation and warehousing service prices.

Affected by soaring energy prices, the U.S. Consumer Price Index (CPI) rose by 1.0% month-on-month in May, much higher than the 0.3% month-on-month increase in April; it rose 8.6% year-on-year, hitting the highest level since December 1981.

Rashid warned: "The global supply chain continues to be affected by the situation in Ukraine and the epidemic, and the Federal Reserve's policy tools cannot play a big role in alleviating supply chain disruptions. Therefore, PPI will continue to rise in the short term, and any sustainable The stabilization and easing may only gradually show up in the second half of 2022. "

data shows that the core PPI after excluding food, energy and trade service prices rose by 0.5% month-on-month, 0.1 percentage points higher than in April; the year-on-year increase slowed to 6.8. %, the same as the previous value.

Combined with previously released CPI data, Bank of America economist Stephen Juneau predicts that the U.S. core personal consumption expenditures (PCE) index may increase by 0.3% month-on-month in May, thus slowing its year-on-year growth to 4.6 %. In April, U.S. core PCE rose 4.9% year-on-year.

![Unbelievable Cosmic Phenomena Beyond Our Galaxy | Secrets Of The Universe [All Episodes] | Spark - DayDayNews](https://i.ytimg.com/vi/sHEwTKEDVM0/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLAOHCCVwEK0S3PEAiMgW9rL4mC6YQ)