China Securities Network News (Reporter Wang Fangyuan) On March 22, the official website of the China Banking and Insurance Regulatory Commission issued the "Reply on the Opening of National Pension Insurance Co., Ltd.", approving the opening of National Pension Insurance Co., Ltd. (referred to as "National Pension"). The reporter learned from National Pension that the company has completed the contractor registration procedures. At this point, practitioners of the third pillar of elderly care, which has attracted much attention since its approval last year, will officially set sail.

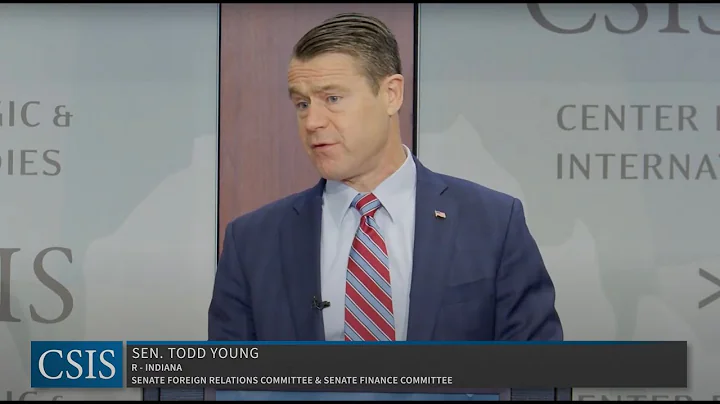

After receiving the approval from the China Banking and Insurance Regulatory Commission, National Pension Insurance staff are removing the word "chi" that has been used throughout the office for nearly 7 months (picture provided by National Pension Insurance Co., Ltd.).

Clear shareholder structure and strong capital strength

Publicly disclosed information shows that National Pension has 17 shareholder units, including six large state-owned banks including Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, and Postal Savings Bank of China, as well as China CITIC Bank, Wholly-owned subsidiaries of five joint-stock banks including China Merchants Bank, Industrial Bank, China Minsheng Bank, and Hua Xia Bank, large insurance and securities institutions and subsidiaries such as Taikang Life Insurance, CITIC Securities, and CICC, as well as Guoxin Capital Co., Ltd., Beijing For domestic industrial investment companies such as Infrastructure Investment Co., Ltd. and Beijing Xicheng Capital Holdings Co., Ltd., shareholders’ investments range from 200 million yuan to 1 billion yuan. The clear shareholder structure and balanced equity distribution lay the foundation for National Pension to create a coordinated and effective governance structure with checks and balances.

According to China Banking and Insurance Regulatory Commission approval documents and public disclosure data, the registered capital of National Pension is 11.15 billion yuan, ranking among the top 15 in the registered capital ranking of all life insurance companies, surpassing other pension insurance companies in the market. It is worth noting that there are currently 9 pension insurance companies in the market, all of which are insurance groups or subsidiaries of insurance companies. Relatively speaking, the shareholders of National Pension are mainly large and medium-sized banks, and also cover some leading securities firms and insurance institutions. How to effectively utilize diversified shareholder resources and capabilities and achieve innovation and development of the commercial pension financial market through development synergy is crucial to the development of the national pension business.

Focus on the main business of pension insurance and insist on professionalism and focus

As the country makes overall plans to accelerate the development of the third pillar of pension insurance, there are already clearer "focus" requirements for the positioning and business layout of professional pension insurance companies.

In December 2021, the General Office of the China Banking and Insurance Regulatory Commission issued the "Notice on Regulating and Promoting the Development of Pension Insurance Institutions", clarifying that pension insurance institutions should adhere to the development positioning of professional pension insurance operating institutions, focusing on commercial pension insurance and enterprise (occupational) annuity In business fields with pension attributes such as fund management and pension security management, we actively participate in the construction of the third pillar pension insurance and strive to meet the people's diverse pension security needs.

On March 4, 2022, the China Banking and Insurance Regulatory Commission and the People's Bank of China's "Notice on Strengthening Financial Services for New Citizens" proposed that "insurance institutions are supported to explore and develop high-security, strong security, and insurance products based on the needs and characteristics of new citizens for retirement." A commercial pension insurance product that is simple, flexible in payment and stable in income.”

reporters learned from National Pension that the company will be guided by national policies and guidelines, implement the important arrangements of the Party Central Committee and the State Council on standardizing the development of the third pillar pension insurance, and adhere to the development positioning of a professional pension insurance operating institution in accordance with regulatory requirements , and actively explore new paths and models for financial services and pension security. The company will focus on business fields with elderly care attributes, be guided by market demand, implement the development concept of "inclusiveness, professionalism, innovation, and safety", and take "let the common people see clearly, understand, and operate easily" as the basic starting point, and target To meet the long-term pension and related insurance needs of different groups of people, by promoting innovation in business management models and product and service innovations, we will provide society with robust and applicable product solutions that are differentiated, highly identifiable, commercially sustainable, and easy for ordinary people to understand. At the same time, the company will also strive to give full play to the advantages of shareholders, improve operating efficiency and investment returns by improving channel convenience and product availability, reduce sales expenses and management costs, and strive for greater space for benefiting the people.

![Devotion Ending Theme [Lyrics Video] • No Party For Cao Dong - DayDayNews](https://i.ytimg.com/vi/3vU3TV7mRWQ/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLD6Hu3-7QH9krPYeIQ3yriOqa8Z6A)